How “Sustainable Finance” evolved from a sustainability fig leaf to the most effective lever the EU has. And what you can do for a better world and for a sustainable (!) career. THE TIME IS NOW!

by Heidrun Kopp

Sustainability must not be just a question of ideology. Anyone who wants to shape real change in the direction of a more livable future can drive this forward with management skills: Through processes that make up our economic actions, in a language that management understands, with the most powerful lever at our disposal: money!

Knowledge is power. Make something sustainably good out of it!

It is obvious: In the very near future, many interesting jobs and exciting business models will arise around sustainable finance. In order to understand the complex interrelationships of sustainability and green finance in relation to the different areas of companies and enterprises, one needs the appropriate know-how and many well-trained managers and experts. Maybe that is you!

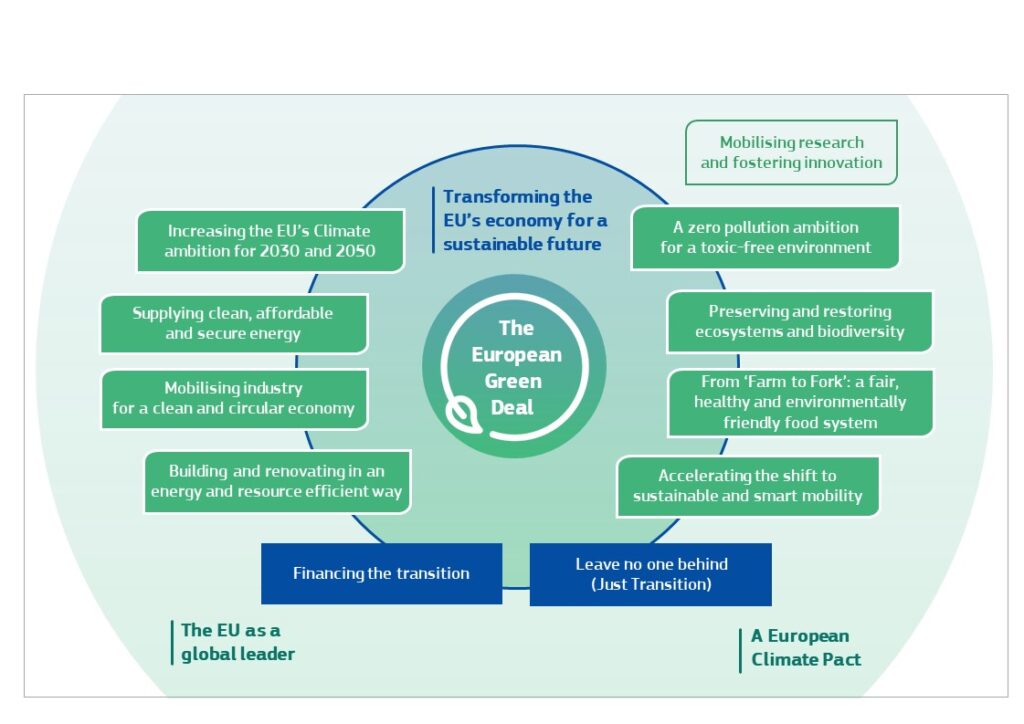

“Sustainable Finance” effectively links those two levels in order to bring the number one issue of the future, environmental protection, into implementation as comprehensively and quickly as possible: The way the finance industry works brings sustainability to our economy, our society and thereby to our environment. This requires a sound knowledge of the importance of finance in the shift towards a more sustainable economy, especially with regard to the EU’s “Green Deal”.

Megatrend & Superpower: “Green Finance” in the EU

With the publication of the EU Action Plan for Financing Sustainable Growth 2018, the EU Commission has come to the conclusion that finance is the linchpin. Because it (alone) is at the center of the resource that can be used to steer where a development goes: money. A financial institution decides which investments it will and will not finance; the finance departments in companies ultimately decide which measures targeted by management (can) be implemented.

At the beginning of my work as a financial expert – many years ago – “sustainability” was only a topic in the context of “corporate social responsibility” (CSR). It was about doing some kind of projects in the company that had either an ecological or a social background. The whole thing was written into the sustainability report and decorated with beautiful pictures. The focus – not only in the financial area – was primarily on side issues and generally not on the core business.

However, this is gradually changing with the EU Action Plan and especially with the so-called “Green Deal” of the EU: In 2019, probably the most effective lever towards sustainability so far emerged from the area of finance/financing.

Because it is relevant WHAT is financed, HOW something is financed and how it is REFINANCED.

The 10 Commandments of the EU Action Plan

Foremost, the imperatives of the EU Action Plan (highlighted here in excerpts) include:

- the desired transformation of the economy towards sustainability

- the identification of sustainability risks

- transparency

This brings us back to the point mentioned at the beginning: you have to speak the language of the economy. You have to know how the economy works in order to be able to feed environmental and climate interests into it.

A major weakness in dealing with sustainability was (and still is) that there is no clear definition of the term. “It means something, but not always the same thing to everybody”, postulated the economist Dow Votaw in the 1970s about CSR: This statement describes exactly the problem that has always existed with this concept.

The EU action plan gives finance a significant, if not the most effective, role in moving towards a more sustainable economy. This is because financing without sustainable aspects will become less attractive in the future.

Since the topic of “Sustainable Finance” is playing an increasingly important role, there is a need for first-class trained employees who can contribute to companies in this regard. This is where our continuing education program at FHWien der WKW comes into play:

More about the university course, the topic and the author

All information about the part-time continuing education program “Sustainable Finance Management” and the four different modules at the Vienna Management Academy by FHWien der WKW can be found under this link.

You can read a deep, quite personally colored and critical insight into the background, motives and genesis of the EU’s “Green Deal” in my article “Money makes the world go green!”.

The author of this article, Dr.in Heidrun Kopp, MBA MA, is Head of Program “Sustainable Finance Management” at FHWien der WKW and prepares interested people in academic continuing education programs to help shape the change towards an ecologically and socially sustainable economy. The expert for sustainability and sustainable finance has many years of experience in the banking sector. She has been working intensively on the topic of sustainability in finance since 2010.

Since July 2020, she has also been covering the most burning issues around sustainability and money in her podcast “Green Money Talks”.

In 2016, Springer Verlag published her book „CSR und Finanzratings. Nachhaltige Finanzwirtschaft – Rating statt Raten!“. In it, she deals with sustainability rating agencies – and was already ahead of her time when the book was published.