As part of the Interdisciplinary Case Studies course, third-semester students of the Bachelor’s program in Finance, Accounting, and Taxation at FHWien der WKW gained exciting insights into current developments in digitalization and the use of artificial intelligence (AI) in tax consulting.

Experts from TPA Steuerberatung used practical examples to show how modern tools and technologies are used in everyday professional life to make processes more efficient and automate routine tasks.

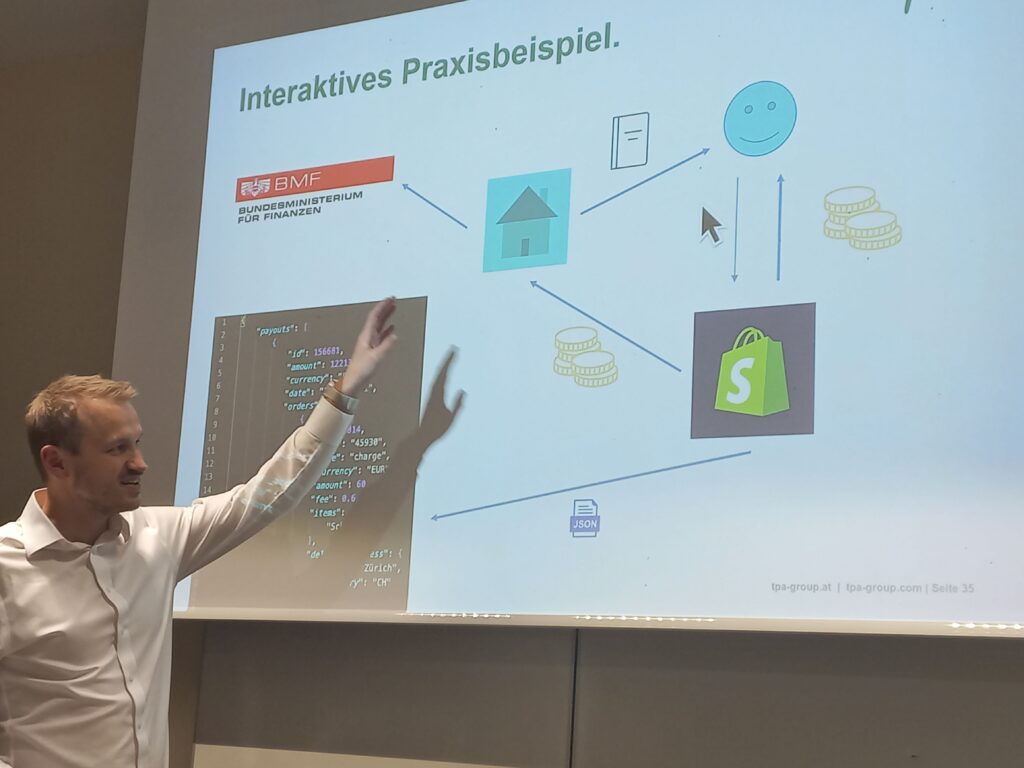

One focus was on the automation of calculation processes. The students had the opportunity to develop their own solution for calculating sales tax and preparing sales tax returns. With the help of an API interface, an automated file was created that can calculate sales tax independently at regular intervals in the future.

AI use in tax consulting

The speakers gave practical examples of how tax consulting firms can use digital applications in conjunction with AI to manage client accounts more efficiently and intelligently. At the same time, they emphasized that the benefits of automation and digital tools must always be accompanied by responsible data handling. Topics such as the General Data Protection Regulation (GDPR) and the profession-specific requirements of the German Public Accountancy Act (WTBG) were therefore also in focus.

The event was rounded off with an outlook on future developments: from expanded AI applications to new digital interfaces that will provide even greater support for everyday work in accounting firms. This gave students a comprehensive picture of the opportunities that digitalization and AI open up in the tax consulting industry – and which skills will be particularly in demand in the future.

>> More information about the Bachelor´s study program Finance, Accounting & Taxation